Most recent

Gavekal Research

What Could Restart Dollar Strength?

Gavekal Research

One Country, Two Currencies

Gavekal Research

Stagflation Or Reflation?

Gavekal Research

China On The Nile

Gavekal Dragonomics

More research

Gavekal Research

Of Gold And Gold Miners

Checking The Boxes

Our short take on the latest news

US existing home sales fell -2.7% MoM to 3.93mn in Jun, down from 1% in May

Below expected -0.7%

Affordability issues continue to weigh down housing sector activity

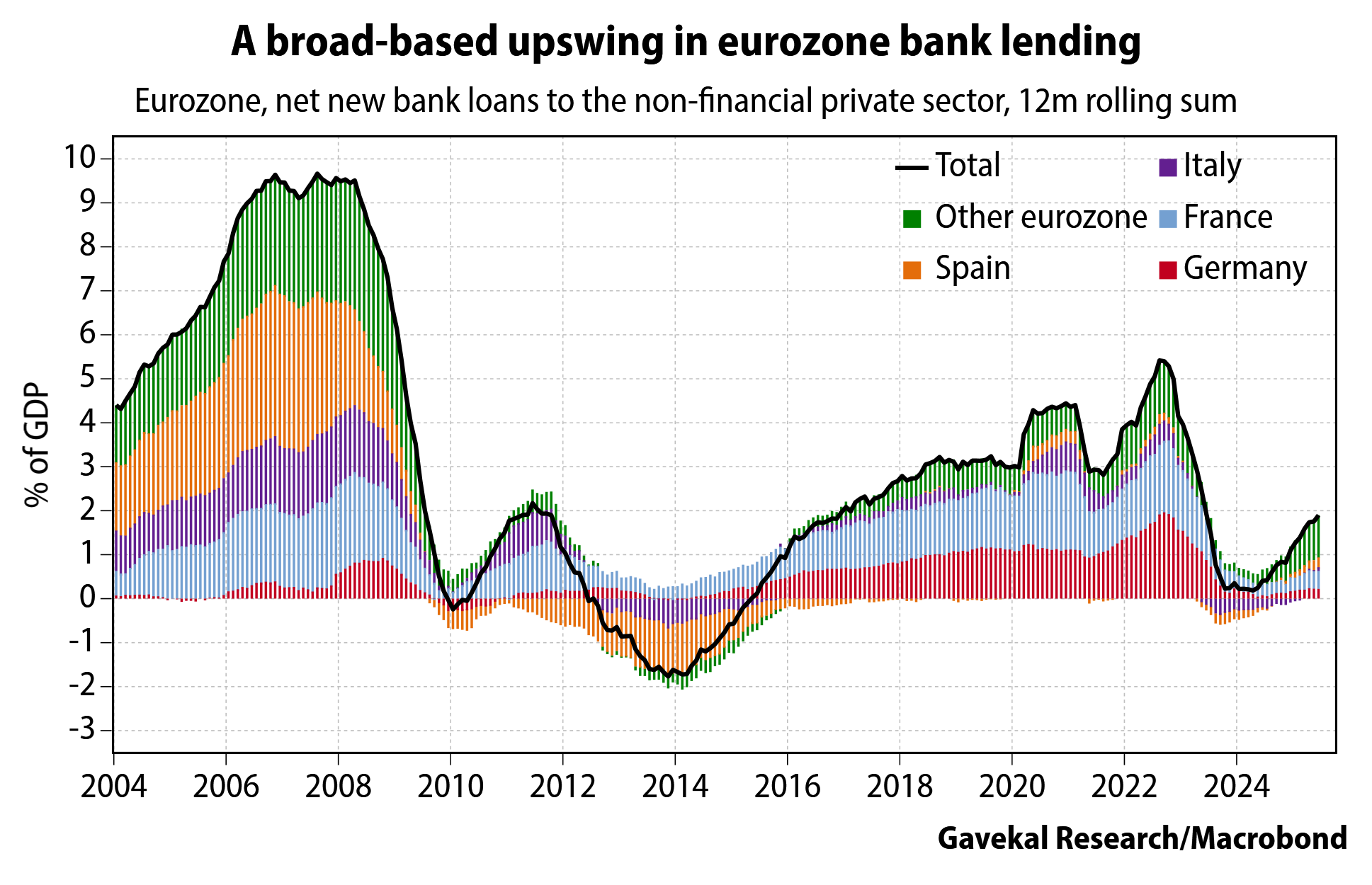

Eurozone consumer confidence indes rose to -14.7 in Jul, up from -15.3 in Jun

Above expected -15

Expect further improvement as economic worries dissipate amid the cyclical recovery

South Korea GDP rose 0.6% QoQ in 2Q, up from -0.2% in 1Q

Above expected 0.4%; YoY, GDP rose 0.5% in 2Q, up from 0% in 1Q

Stimulus measures propping up recovery for now; downside risk from trade remains high

Singapore CPI rose 0.8% YoY in Jun, the same pace as in May

Below expected 0.9%; core CPI rose 0.6% YoY in Jun, the same pace as in May

Subdued inflation risk amid weak growth outlook reinforces case for MAS easing

- Paris

- Singapore

- São Paulo

- Hong Kong

- Riyadh

Chart of the Week

The global view

Book list

Gavekal Research

Recommended Reading

Gavekal Research